Ungabala njani umsebenzi wase-Australia kunye ne-GST xa ungenisa usuka e-China usiya e-Australia?

Umsebenzi wase-Australia/i-GST ihlawulwe kumasiko e-AU okanye urhulumente oya kukhupha i-invoyisi emva kokuba wenze imvume yase-Australia

I-invoyisi yase-Australia/i-invoyisi ye-GST inamacandelo amathathu angu-DUTY, GST kunye ne-ENTRY CHARGE.

1.Umsebenzi uxhomekeke kuluphi uhlobo lweemveliso.

Kodwa njengoko iChina isayine isivumelwano sokurhweba simahla kunye ne-Australia, ukuba unokubonelela ngesatifikethi se-FTA, ngaphezulu kwe-90% yeemveliso ezivela e-China azikho mthwalo. Isatifikethi se-FTA sikwabizwa ngokuba sisatifikethi se-COO kwaye sisetyenziselwa ukubonisa ukuba iimveliso zenziwe eTshayina.

I-2.GST yinxalenye yesibini ekufuneka uyihlawule kumasiko e-AU xa ungenisa eChina.

I-GST yi-10% yexabiso lomthwalo ekulula ukuyiqonda

3.Intlawulo yokungenela sisahlulo sesithathu esinokuthi sihlawuliswe ngamasiko e-AU kwaye ikwabizwa ngokuba zezinye iintlawulo. Inxulumene nexabiso lempahla elihlala lisuka kwi-AUD50 ukuya kwi-AUD300.

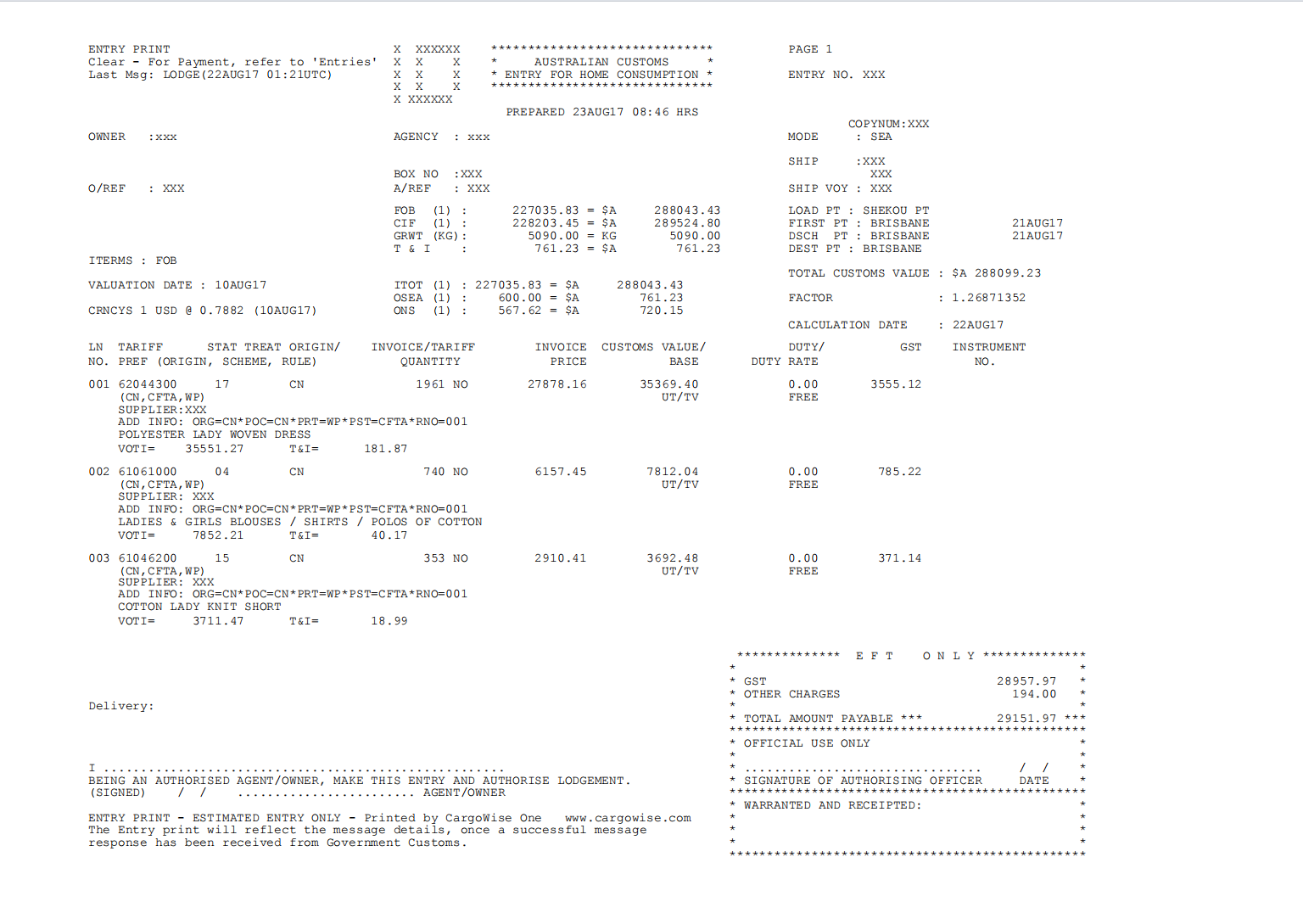

Apha ngezantsi kukho umzekelo we-invoyisi ye-Australian duty/gst ekhutshwe ngamasiko e-AU :

Nangona kunjalo, ukuba ixabiso lomthwalo wakho lingaphantsi kwe-AUD1000, ungafaka isicelo se-zero AU duty/gst. Amasiko aseOstreliya ayengayi kukhupha i-invoyisi

For more information pls visit our website www.dakaintltransport.com or email us at robert_he@dakaintl.cn or telephone/wechat/whatsapp us at +86 15018521480

Ixesha lokuposa: Oct-24-2023